8.1. RECALLING RATIOS AND PERCENTAGES

We know, ratio means comparing two quantities.

A basket has two types of fruits, say, 20 apples and 5 oranges.

Then, the ratio of the number of oranges to the number of apples = 5 : 20.

The comparison can be done by using fractions as, The number of oranges are th the number of apples. In terms of ratio, this is 1 : 4, read as, “1 is to 4”

OR

Number of apples to number of oranges which means, the number of apples are 4 times the number of oranges. This comparison can also be done using percentages.

| There are 5 oranges out of 25 fruits. So percentage of orange is [Denominator made 100] |

OR

| By unitary method Out of 25 fruits number of oranges are 5. So out of 100 fruits, number of oranges |

Since  contains only apples and oranges, So, percentage of apples + percentage of oranges = 100 or percentage of apples + 20 = 100 or percentage of apples = 100 – 20 = 80

contains only apples and oranges, So, percentage of apples + percentage of oranges = 100 or percentage of apples + 20 = 100 or percentage of apples = 100 – 20 = 80

Thus the basket has 20% oranges and 80% apples.

8.2. FINDING THE INCREASE OR DECREASE PERCENT

We often come across such information in our daily life as.

(i) 25% off on marked prices

(ii) 10% hike in the price of petrol

Let us consider an example.

Example : The price of a scooter was Rs. 34,000 last year. It has increased by 20% this year. What is the price now ?

Solution

| First find the increase in the price, which is 20% of Rs. 34,000, and then find the new price. 20% of Rs 34000 = Rs 6800 New price = Old price + Increase =Rs 34,000+Rs 6,800 = Rs 40,800 |

OR

| Unitary method 20% increase means, Rs 100 increased to Rs 120. So, Rs 34,000 will increase to ? Increased price = = Rs 40,800 |

Similarly, a percentage decrease in price would imply finding the actual decrease followed by its subtraction the from original price.

Suppose in order to increase its sale, the price of scooter was decreased by 5%.

Then let us find the price of scooter.

Price of scooter = Rs. 34000

Reduction = 5% of Rs. 4000

New price = Old price – Reduction = Rs. 34000 – Rs. 1700 = Rs. 32300

8.3. FINDING DISCOUNTS

Discount is a reduction given on the Marked Price (MP) of the article.

This is generally given to attract customers to buy goods or to promote sales of the goods. You can find the discount by subtracting its sale price from its marked price.

So, Discount = Marked price – Sale price

Let us consider an example.

Example : An item marked at Rs. 840 is sold for Rs. 714. What is the discount and discount % ?

Solution : Discount = Marked Price – Sale Price

= Rs. 840 – Rs. 714

= Rs. 126

Since discount is on marked price, we will have to use marked price as the base.

On marked price of Rs. 840, the discount is Rs. 126.

On MP of Rs. 100, how much will the discount be ?

Discount

We can also find discount when discount % is given.

Estimation in percentages

Your bill in a shop is Rs. 577.80 and the shopkeeper gives a discount of 15%. How would you estimate the amount to be paid ?

(i) Round off the bill to the nearest tens of Rs. 577.80, i.e., to Rs. 580.

(ii) Find 10% of this, i.e., Rs.

(iii) Take half of this, i.e.,

(iv) Add the amounts in (ii) and (iii) to get Rs. 87.

You could therefore reduce your bill amount by Rs. 87 or by about Rs. 85, which will be Rs. 495 approximately.

1. Try estimating 20% of the same bill amount.

2. Try finding 15% of Rs. 375.

8.4. PRICES RELATED TO BUYING AND SELLING (PROFIT AND LOSS)

For the school fair (mela) I am going to put a stall of lucky dips. I will charge Rs. 10 for one lucky dip but I will buy items which are worth Rs. 5.

So you are making a profit of 100%.

No, I will spend Rs. 3 on paper to wrap the gift and tape. So my expenditure is Rs. 8.

This gives me a profit of Rs. 2, which is, only.

Sometimes when an article is bought, some additional expenses are made while buying or before selling it. These expenses have to be included in the cost price.

These expenses are sometimes referred to as overhead charges. These may include expenses like amount spent on repairs, labour charges, transportation etc.

Finding cost price/selling price, profit %/loss%

Let us consider an example.

Example : Sohan bought a second hand refrigerator for Rs. 2,500, then spent Rs. 500 on its repairs and sold it for Rs. 3,300. Find his loss or gain percent.

Solution : Cost Price (CP) = Rs. 2500 + Rs. 500 (overhead expenses are added to give CP)

= Rs. 3000

Sale Price (SP) = Rs. 3300

As SP > CP, he made a profit = Rs. 3300 – Rs. 3000 = Rs. 300

His profit on Rs. 3,000, is Rs. 300. How much would be his profit on Rs. 100 ?

8.5. SALES TAX/VALUE ADDED TAX

The teacher showed the class a bill in which the following heads were written.

|

Bill No |

Date |

||||

|

Menu |

|||||

|

S.No. |

Item |

Quantity |

Rate |

Amount |

|

|

|

|

Bill amount + ST (5%) |

|

|

|

|

|

Total |

|

|

|

|

ST means Sales Tax, which we pay when we buy items.

This sales tax is charged by the government on the sale of an item.

It is collected by the shopkeeper from the customer and given to the government.

This is, therefore, always on the selling price of an item and is added to the value of the bill.

These days however, the prices include the tax known as Value Added Tax (VAT).

8.6. COMPOUND INTEREST

We might have come across statements like “one year interest for FD (fixed deposit) in the bank @ 9% per annum” or ‘Savings account with interest @ 5% per annum’.

Interest is the extra money paid by institutions like banks or post offices on money deposited (kept) with them. Interest is also paid by people when they borrow money.

We already know how to calculate Simple Interest.

We have some money in the bank. Every year some interest is added to it, which is shown in the passbook. This interest is not the same, each year it increases. Normally, the interest paid or charged is never simple. The interest is calculated on the amount of the previous year.

This is known as interest compounded or Compound Interest (C.I.).

Let us take an example and find the interest year by year. Each year our sum or principal changes.

Calculating Compound Interest

A sum of Rs. 20,000 is borrowed by Heena for 2 years at an interest of 8% compounded annually. Find the Compound Interest (C.I.) and the amount she has to pay at the end of 2 years. Aslam asked the teacher whether this means that they should find the interest year by year. The teacher said ‘yes’, and asked him to use the following steps :

1. Find the Simple Interest (S.I.) for one year.

Let the principal for the first year be . Here, = Rs. 20,000

= SI at 8% p.a.

for 1st year = Rs.

2. Then find the amount which will be paid or received. This becomes principal for the next year.

Amount at the end of 1st year

= + = Rs. 20000 + Rs. 1600

= Rs. 21600 = (Principal for 2nd year)

3. Again find the interest on this sum for another year.

4. Find the amount which has to be paid or received at the end of second year.

Amount at the end of 2nd year =

= Rs. 21600 + Rs. 1728 = Rs. 23328

Total interest given = Rs. 1600 + Rs. 1728 = Rs. 3328

Reeta asked whether the amount would be different for simple interest. The teacher told her to find the interest for two years and see for herself.

SI for 2 years = Rs.

Reeta said that when compound interest was used Heena would pay Rs. 128 more.

8.7. FORMULA FOR COMPOUND INTEREST

Suppose is the sum on which interest is compounded annually at a rate of R% per annum.

Let = Rs. 5000 and R = 5% per annum. Then by the steps mentioned above

1.

2.

Proceeding in this way the amount at the end of n years will be

Or, we can say

Using this we get only the formula for the amount to be paid at the end of n years, and not the formula for compound interest.

Aruna at once said that we know that CI = A – P, so we can easily find the compound interest too.

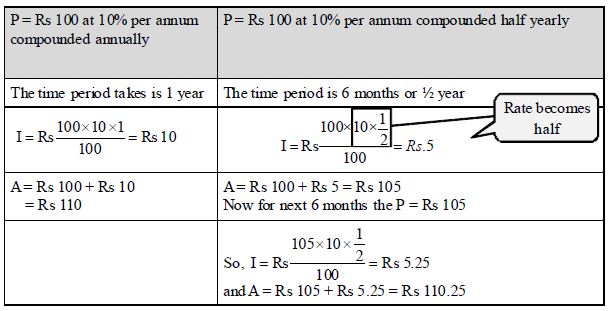

8.8. RATE COMPOUNDED ANNUALLY OR HALF YEARLY (SEMI ANNUALLY)

| Time period and rate when interest not compounded annually The time period after which the interest is added each time to form a new principal is called the conversion period. When the interest is compounded half yearly, there are two conversion periods in a year each after 6months. In such situations, the half yearly r ate will be half of the annual rate. What will happen if interest is compounded quarterly? In this case, there are 4 conversion periods in a year and the quarterly rate will be one-fourth of the annual rate. |

8.9. APPLICATIONS OF COMPOUND INTEREST FORMULA

There are some situations where we could use the formula for calculation of amount in CI. Here are a few.

(i) Increase (or decrease) in population.

(ii) The growth of a bacteria if the rate of growth is known.

(iii) The value of an item, if its price increases or decreases in the intermediate years.

Let us consider an example.

Example

The population of a city was 20,000 in the year 1997. It increased at the rate of 5% p.a. Find the population at the end of the year 2000.

Solution

There is 5% increase in population every year, so every new year has new population.

Thus, we can say it is increasing in compounded form.

Population in the beginning of 1998 = 20000 (we treat this as the principal for the

1st year)

Increase at

Population in 1999 = 20000 + 1000 = 21000 [Treat as the Principal for the 2nd year.]

Increase at

Population in 2000 = 21000+1050 = 22050 [Treat as the Principal for the 3rd year.]

Increase at

At the end of 2000 the population = 22050 + 1102.5 = 23152.5 or,

Population at the end of 2000

= 23152.5

So, the estimated population = 23153.